Of the twenty-three brand categories MarketCast studies, the average Fandom score for the financial category ranks near the bottom. That might make some view the industry as futile or out of touch, but we see it as an opportunity for brands to improve and build Fandom.

Like the insurance sector, the investment and banking categories offers telltale signs of where brands could focus their marketing efforts if they know where to look. Luckily for financial brand marketers, that’s where we can help.

MarketCast’s Fandom Model (part of our Brand Tracking+ research solution) reveals various ways to turn consumers into long-term fans by utilizing our three Fandom pillars: Presence, Distinction, and Relevance.

Here, There, Everywhere

In an ultra-competitive marketplace, our Brand Presence metrics provide a view of how well brand messaging is breaking into consumer consciousness and fueling recognition. The majority of brands in the banking and investing categories achieve strong awareness through high ad spending and frequency, but the two standouts, according to our research, are Chase and Capital One.

Chase’s Brand Presence score of 620 is markedly above the average thanks to a mix of advertising on TV, in OOH channels, sports sponsorships, and direct online spend. Combined, this has created an investment and banking brand that’s consistently top of mind with consumers we spoke with.

By contrast, Capital One sits right behind Chase in two of our three Brand Presence metrics and in the top three for overall MarketCast Brand Fandom within the category. With a media spend of more than $4 billion in 2023 mostly in TV advertising, many of its ad campaigns score above the norm within MarkteCast’s ad performance database.

A Trusted Partner

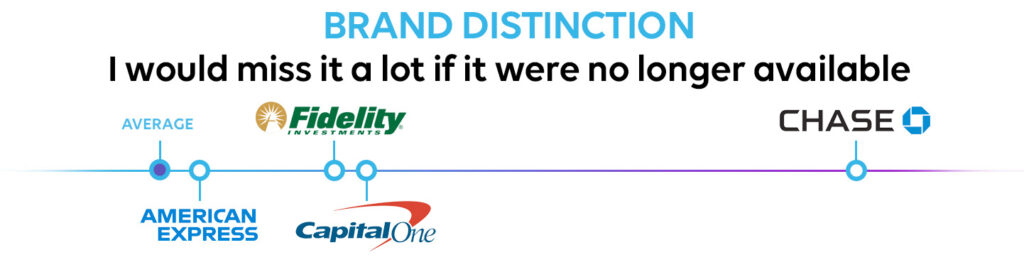

MarketCast’s Brand Distinction metrics are a way for brands to gauge their uniqueness or attractiveness to consumers. It manifests itself in this category as being reliable, trustworthy, or having a strong brand mission. According to our research, Chase is seen as highly trusted and reliable and has a positive impact for its customers. Still, Fidelity distinguishes itself in other ways that consumers find appealing, focusing on financial literacy, especially among consumers aged 13-24.

Fidelity’s traditional ad creative positions the brand as a partner capable of shepherding its customers through any life challenge. The brand consistently scores well on Brand Linkage in our ad performance database. But that’s not the only place the brand’s marketing shines.

Fidelity’s Youth program, launched in 2021, offers brokerage accounts to teenagers under parental supervision. To participate, parents must also have a Fidelity account, transforming financial literacy into a shared learning experience for both generations. For the company’s marketers, the program is a savvy way of engaging young people with the Fidelity brand long before they mature into adult investors.

Making Banking and Investment Brands Relevant

Investing can be a risky business, but it’s made easier when investment brands can seamlessly embed themselves into consumer’s lives and make investing less painless by providing value through high-quality service and products. When it comes to MarketCast’s Brand Relevance category, Charles Schwab fits the bill by offering both the aforementioned qualities through messaging that positions the brand as always doing right by their customers and challenging tired category conventions.

Other banking and investment brands performing well in this area include AMEX and Citi, both scoring above the norms for offering high quality products and services and good value for money.

Looking Ahead

With the advent of robo-advisors, app-first investment platforms and social “movements” like FIRE (Financial Independence, Retire Early), or lifestyles like DINKs (Double Income, No Kids), attracting a new generation of investment enthusiasts requires a mix of tradition, trust and thinking outside the box.

Want to know how your Brand Fandom measures up? MarketCast uses its Brand Tracking+ solution and its unique Fandom Model to study a wide range of brands across categories, from QSR to Insurance and Banking, Automotive, and Entertainment.