With more streaming options than ever, the battle for subscribers’ hearts and minds rages on. But with over 20 streaming services available in the U.S. alone, customer acquisition, retention, and satisfaction are vital in maintaining a successful platform and not always easy to understand.

We tapped the MarketCast Streaming Tracker, a monthly survey of streaming video subscribers, to examine how they feel about today’s biggest streaming services and the content they offer.

Scroll on to see the latest insights from MarketCast’s Streaming Tracker for Q2 2023:

Streaming services with smaller catalogs that rely heavily on new original content saw the biggest shift in subscriber satisfaction

With the highly-anticipated release of the final episodes of the hit series Ted Lasso, Apple TV+ experienced a nearly 5-point jump in how their subscribers rate the quality of the platform’s original content (up to 77 points on a 100-point scale) in May. However, once the series was done in June, Apple TV+ experienced a subsequent 5-point drop-off in the same metrics. This pattern suggests newer platforms with smaller libraries, and more reliance on new content, will have to work a bit harder to keep subscribers happy over time.

Meanwhile, streaming services with deeper catalogs, such as Netflix and Disney+, exhibited remarkable consistency in month-over-month original content quality satisfaction. Disney+ averaged a 76-point approval score for the quarter (with a 1-point swing), while Netflix delivered the most consistent scores at 75 points every month in the quarter.

Having a deep catalog plus new original content can help boost overall subscriber satisfaction

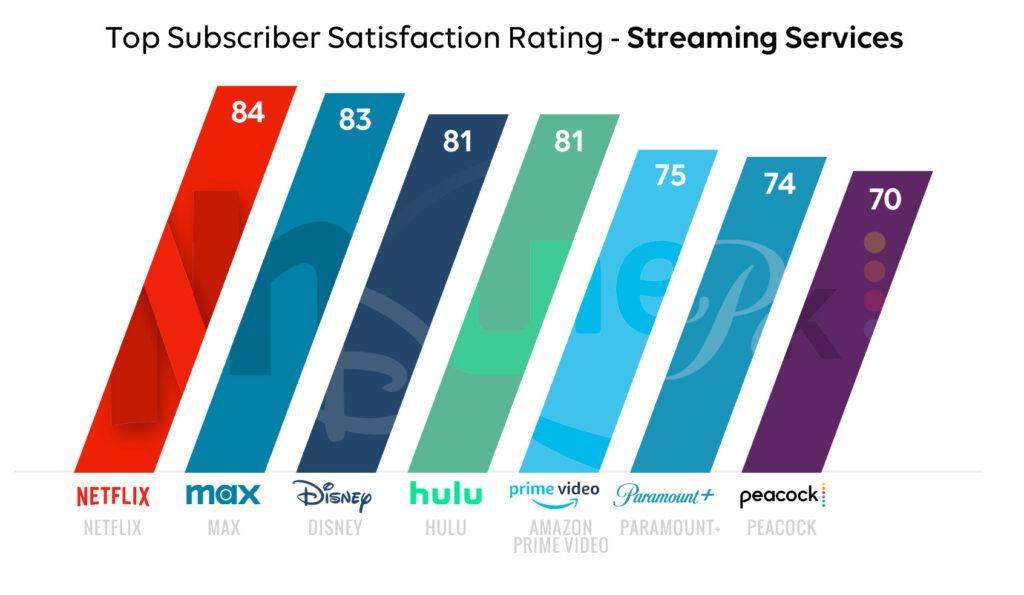

When looking at the big players in the game, Netflix, Max (formerly HBO Max), Disney+, and Hulu all have the best overall subscriber satisfaction among streamers. Netflix leads the pack at 84 points, followed closely by Max at 83 points, and Disney and Hulu tied at 81 points. All four platforms have deep catalogs of established content that viewers can dig into, plus new, wildly popular original series to keep up with. This robust content variety and an easy overall user experience earned these platforms their high scores.

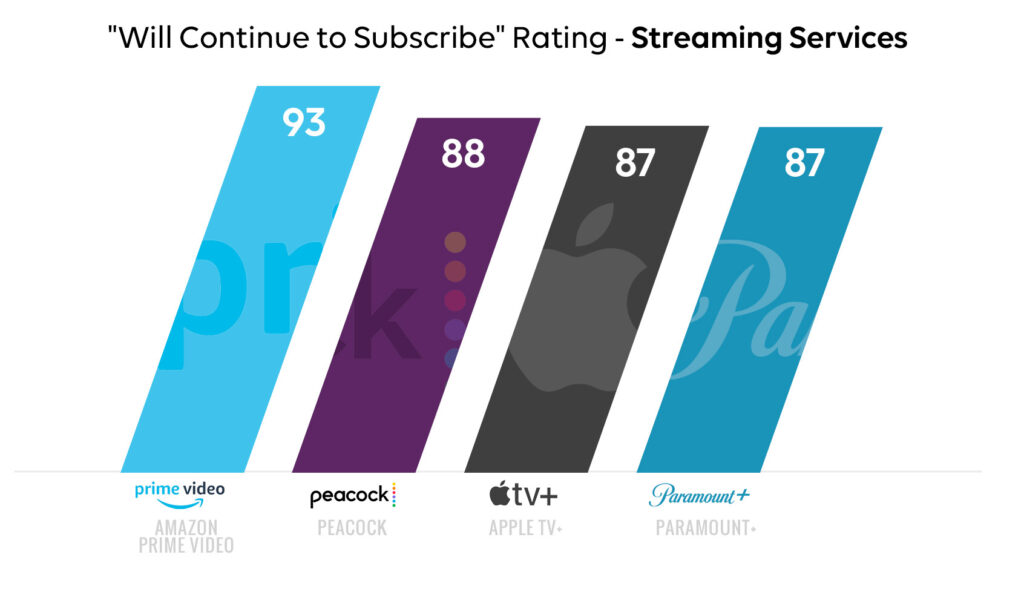

Despite being one of the “first wave” streaming services, Amazon Prime Video has a lower overall Q2 subscriber satisfaction rating of 75 points compared to competitors Netflix and Hulu. However, Amazon Prime Video, which often benefits from its association with Amazon Prime, delivers a solid 93-point score in the category of those “planning to continue their paid subscription,” compared to a very respectable 87 points for Apple TV+ and Paramount+.

New contenders in the space are working hard to compete with the streaming giants

New to the game but not to be taken lightly, Paramount+ and Peacock earned decent scores in overall subscriber satisfaction. Paramount+ averaged 74 points in Q2 (10 points below the leader), while Peacock delivered a 70-point Q2 average score, but scored very well for “planning to continue to subscribe” with 88 points (on par with Apple TV+ and Paramount+). Both platforms have libraries to pull from, and are beginning to make headway with original content to draw subscribers in.

Among AVOD (ad-supported video-on-demand) watchers, Freevee (formerly IMDB TV) was a surprising breakout, with more than half of those surveyed saying they use the free ad-supported service. This boost may have been driven by Freevee’s recent hit with Jury Duty, the mockumentary-style comedy that generated unprecedented social media buzz for an AVOD original series.

How will the Writers Guild of America (WGA) and Screen Actors Guild (SAG-AFTRA) impact streaming fandom satisfaction? Time will tell. With new original content on pause for the foreseeable future, we will monitor how subscriber satisfaction changes or remains the same.

Stay tuned for more insights into the world of OTT entertainment and subscriber satisfaction from MarketCast’s Streaming Tracker. To learn more about how our Entertainment Research team can help you optimize your movies, TV shows, and streaming series, give us a shout!