Gen Z Doubles Down on “Buy Now, Pay Later” Apps

Consumer’s love of alternative payment methods dates back centuries. Here in the U.S., lay-away programs once ruled retail, and still exist today, allowing shoppers to put items “on hold” as they pay a series of installments. The credit card boom, starting in the 60s, allowed consumers to increasingly throw down their plastic to make purchases and defer payments, often resulting in an endless cycle of high interest debt.

Enter a new generation of “Buy Now, Pay Later” (BNPL) apps, which combine the best of both worlds. With BNPL, consumers can buy and receive those fresh new kicks now, but get the convenience of paying for them in 3-4 interest-free installments.

After taking a closer look at BNPL purchasing behavior, MarketCast found that Gen Z is turning up the volume on buy now pay later apps the most, especially for larger purchases. Since their income is limited, based on their age and life stage, Gen Z are more apt to take advantage of BNPL services that allow them to make high-ticket purchases, including clothing and beauty products.

Popular BNPL Apps

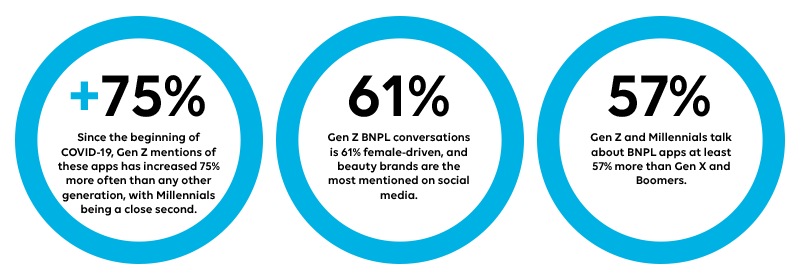

MarketCast’s Gen Z Trend Tracker analyzed the organic opinions, across social and digital media, of those who self-identify as Gen Z (ages 13-25) to best understand how this cohort is embracing buy now pay later. Key findings include:

- BNPL has experienced a 75% increase in conversation from the Gen Z cohort since the onset of COVID.

- Beauty brands are the most referenced consumer segments related to BNPL.

- 61% of the social conversation about BNPL is by Gen Z females.

Among the brands gaining the most traction are following:

- Klarna experienced record growth in 2020 by being the first business of its kind featured in a Super Bowl ad.

- Sephora and Urban Outfitters were two of the most mentioned brands among Gen Z using these apps.

- These apps also partnered with popular influencer branded businesses like KKW Beauty, Kylie Cosmetics and Morphe Cosmetics.

Why it Matters

Despite the increased popularity of these apps, there’s still room for consumer brands and online retailers to enter the conversation across audiences. Specifically, our Gen Z tracker found young, Black women were exploring BNPL apps for a wide range of purchases, from haircare and beauty to clothing. Additionally, as the Gen Z cohort ages and their income increases, the buying behaviors learned today could translate into a wider array of brands and segments.

To learn more about our BNPL research and our Gen Z Cohort Tracker, contact us.