As Fall begins to creep into our collective subconscious (and with it, pumpkin spice everything), the long-awaited return of football season is finally here. With the season officially in full swing, we are turning our attention to the sponsors of the NFL and how they stack up compared to the 2022-2023 season.

Since 2007, MarketCast has conducted annual sponsor breakthrough studies* around North America’s top sports leagues to evaluate the sponsors’ relative positions and fan engagement. We tapped the data from this study to examine the most recognized sponsors in the NFL (official or otherwise) and how that recognition translates to brand awareness.

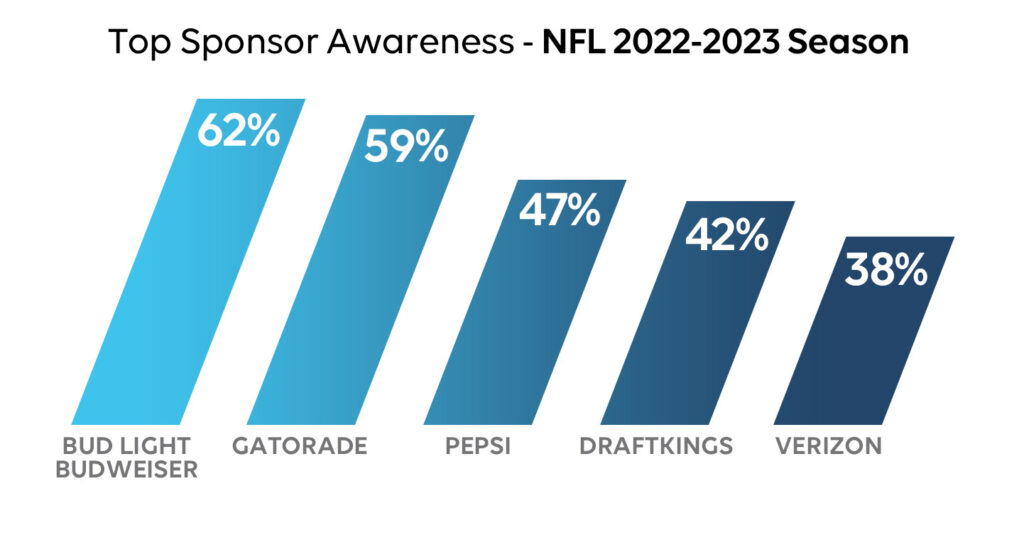

It may come as no surprise, Bud Light/Budweiser remains the most recognized sponsorship in the league, with 62 percent of fans correctly identifying the beer brand as the league’s official sponsor in 2022-23. This is due to the longstanding partnership with the organization. Despite the beer manufacturer taking a sponsorship break between 2001 and 2011, they have managed to maintain their recognition among football fans.

Other longstanding sponsorships that continue to pay dividends are Gatorade (a sponsor since 1983), delivering 59 percent sponsor awareness, followed by Pepsi (a sponsor since 2002) at 47 percent. These high scores emphasize the importance of longevity in sports sponsorship and the vital role fans play in making a sponsor synonymous with a sports league, raising brand awareness, and ultimately, leading to purchase consideration.

Little Caesar’s Charges the Field

When comparing year-over-year, we see that Little Caesar’s, which began its partnership with the NFL in 2022, is the fastest-growing sponsor in recognition, rising 17 percent in just one year. In 2022, Little Caesar’s took over for Pizza Hut as the league’s official pizza sponsor, launching the multi-year partnership with a :30 ad spot (featuring Los Angeles Rams quarterback Matthew Stafford and other NFL players). This was supported by a new Pizza!Pizza! Pre-game promotion and a charitable giving initiative that serves pizza to communities in need surrounding NFL events. While Little Caesar’s still has a way to go before it reaches the recognition levels of its tenured counterparts, the pizza brand’s explosion in the space suggests it will continue its swift climb in the rankings.

Interestingly, NFL sponsors aren’t the only brands that received recognition last season. Despite Little Caesar’s claiming the title of official pizza sponsor of the NFL, Papa John’s continues to take recognition from the rookie sponsor, having sponsored the league from 2010 until 2018. Even though the brand hasn’t been an official sponsor in five years, Papa John’s continues to claim 23 percent sponsor awareness, compared to Little Caesar’s 21 percent and Pizza Hut’s 13 percent.

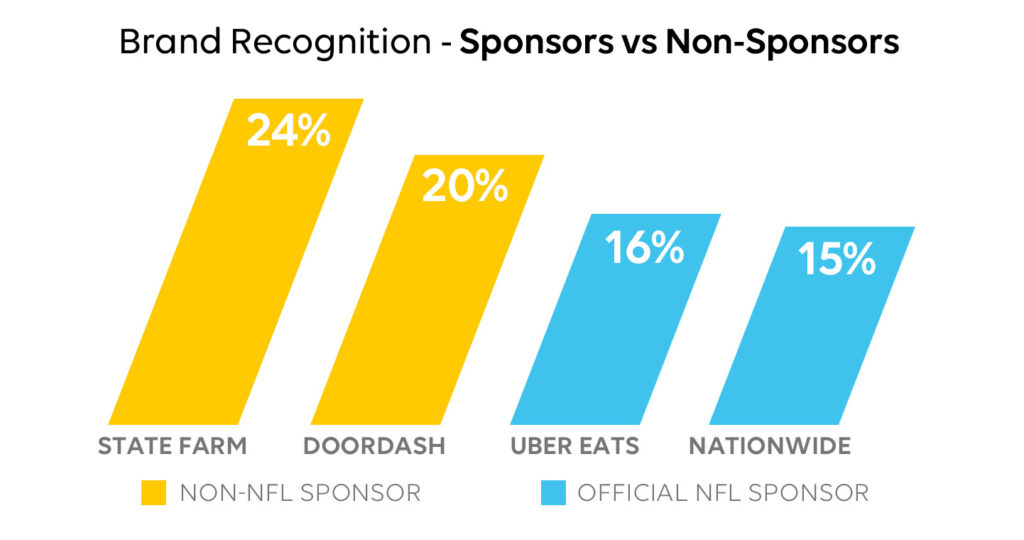

Little Caesar’s isn’t the only NFL sponsor being challenged for brand awareness by non-sponsors. Uber Eats (sponsor since 2020) and Nationwide (sponsor since 2014), are being nudged out to DoorDash and State Farm in terms of sponsor awareness. Both State Farm and DoorDash have a history of featuring NFL players and personalities in their advertising for years, so it’s no surprise viewers would mistake them as official sponsors of the league. The non-sponsors’ high rate of sponsor awareness further proves the power of contextual advertising (including references to the NFL in the ads placed in that viewing environment,) which can also aid in an ad’s general recall and message credibility.

Stay tuned throughout the NFL season as the sports research experts at MarketCast continue to monitor the top brand sponsorships and advertising in the league and provide insights on performance. Looking to take your sports sponsorship performance into the end zone? Give us a shout!

*In conjunction with Sports Business Journal